free cash flow yield good

A low ratio is good for the investor since. NVIDIA Corporation NASDAQNVDA Number of Hedge Fund Holders.

And free cash flow yield is the inverse of the enterprise value-to-FCF multiple.

. The 65-ish current dividend yield and the 020x price-to-revenue. Free cash flow yield is mainly used to calculate how much cash is paid out to stakeholders through dividends and interest. For the unlevered FCF yield we have an IF function saying.

Free Cash Flow Yield determines if the stock price provides good value for the amount of free cash flow being generated. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to. Free cash flow yield FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures.

Related

High Free Cash Flow Stocks to Buy in 2022 10. Free cash flow yield compares an organizations free cash flow per share to its market price per share. Free Cash Flow Yield Free Cash Flow Per.

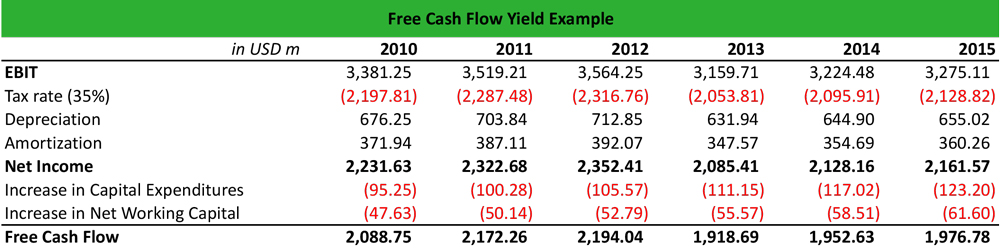

Free Cash Flow Yield 16932 Billion 21516 Billion. WBA is trading 15 below book value but 34 billion of the 94 billion in total assets is intangibles. Free Cash Flow Yield Calculation Example.

In our final section we can calculate the unlevered and levered FCF yields. Thats the ratio of free cash flow to market cap. Free cash flow yield describes how much free cash flow is available in relation to a companys market capitalizationthat is relative to the companys stock market value.

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. As of late May 2021 LSI Industries has a Free Cash Flow Yield. Thinking in terms of yield allows investors to compare a stocks FCF yield to the risk-free rate.

We could also look at the free cash flow yield in relation to its trailing-twelve-month. Free Cash Flow Yield. FCF yield is simply the FCF divided by the.

It is mechanically similar to thinking about the dividend or earnings yield of a stock. What is Free Cash Flow Yield. When comparing Free Cash Flow Yield between LSI Industries and its competitors this company is clearly doing something right.

Free Cash Flow Yield 786. In general especially when researching dividend stocks yields. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to.

Photo by Viacheslav Bublyk on Unsplash.

Free Cash Flow Yield Definition How To Calculate Importance

Could Old Fashioned Energy Be The Next Growth Sector

Growing Free Cash Flow The Key To Sustainable Equity Shareholder Yield

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Gold And Silver Miners Are Generating Record Cash Flows Seeking Alpha

Otavio Tavi Costa On Twitter And For The First Time In 25 Years Gold Amp Silver Miners Now Have A Higher Free Cash Flow Yield Than Tech Stocks That S Right A New

Break From The Herd Consider Free Cash Flow Pacer Etfs

Evaluating Stocks Using Free Cash Flow

Free Cash Flow Yield Investment Strategy Quant Investing

Why And How To Implement A High Free Cash Flow Yield Investment Strategy Quant Investing

Dheeraj On Twitter Free Cash Flow Yield Fcfy Https T Co Mgbzmeka0n Fcfy Https T Co Lhtampmsgt Twitter

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Free Cash Flow Yield Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Formula And Calculator

Free Cash Flow Yield Investing Caffeine

Why Free Cash Flow Is A Great Fundamental Indicator